Blog

Gather Updates

Feb 12, 2018

Brian Elliott

As you may have heard, there was a big stir in the design community last week.

Ivy, a project management tool for Interior Designers was purchased for a tidy sum of money by Houzz.

It’s not surprising that many designers found the marriage concerning. Houzz has a “complicated” relationship with designers and Ivy’s community is wondering what the acquisition will mean for their data and the future of the Ivy platform.

The announcement caught us by surprise here at Gather too. But we weren’t TOO surprised.

Software development is an expensive endeavor and there are two ways that tech entrepreneurs can approach funding:

1) Outside investment. Usually in two flavors: “Angels” (private individuals or funds) and “Venture Capital” (institutional investors).

2) Self-funding (also called ‘Bootstrapping’).

There are no bank loans for startups, typically, as they are considered too risky and difficult to value.

Let’s look at option 1: outside investment. Simply put, this just means Other People’s Money. In exchange for that capital, the investor expects what is referred to as an “outsized outcome”….meaning that the business they are investing in will sell to a larger company for a big sum of money, or they will go public.

There is no other outcome that is acceptable to institutional investors. VC’s and Angels typically place bets (“invest”) in a number of different startups in the hopes that a few of them will sell for large sums and offset the other 90% that go belly up.

It’s just how the game is played in Silicon Valley.

Ivy was VC funded (to the tune of 3 million dollars), so it was only a matter of time before they sold to a bigger fish. We certainly don’t blame them, in fact, I congratulate them…as I mentioned, it’s how the game is played if you choose to play that game.

Some companies, like Gather, choose to reject that game and fund themselves. This approach has advantages and disadvantages.

One key disadvantage is that self-funded companies grow more slowly. They rely on revenue to grow and have to manage cash flow carefully. Often times (as is the case with Gather) self-funded startups invest their own time and savings to create something they feel needs to exist in the world.

However, despite this disadvantage, there are also some great reasons to self-fund a software startup.

The most obvious is that bootstrapped companies don’t need to have an “outsized outcome” to be successful. As is our case, we don’t need to be the biggest house on the street.

Like a boutique design firm, we just need to provide unique value to our customers and hope they spread the word. The more we grow, the more we can invest in additional features and improvements for our customers.

Building Gather has been exciting and challenging and we are so very thankful to our tribe of supportive and (sometimes fanatical) customers that help guide us in our mission. You keep us honest, and we will always work hard and advocate for you.

We believe strongly that it’s important that designers have options for the tools they use. We also understand that there is no “one-size-fits-all” approach to the way designers work.

If you are already a customer, thank you from the bottom of our heart…without your guidance and support, Gather would not exist. We don’t have big marketing budgets and rely heavily on word of mouth, so if you like what we are doing, please, kindly spread the word.

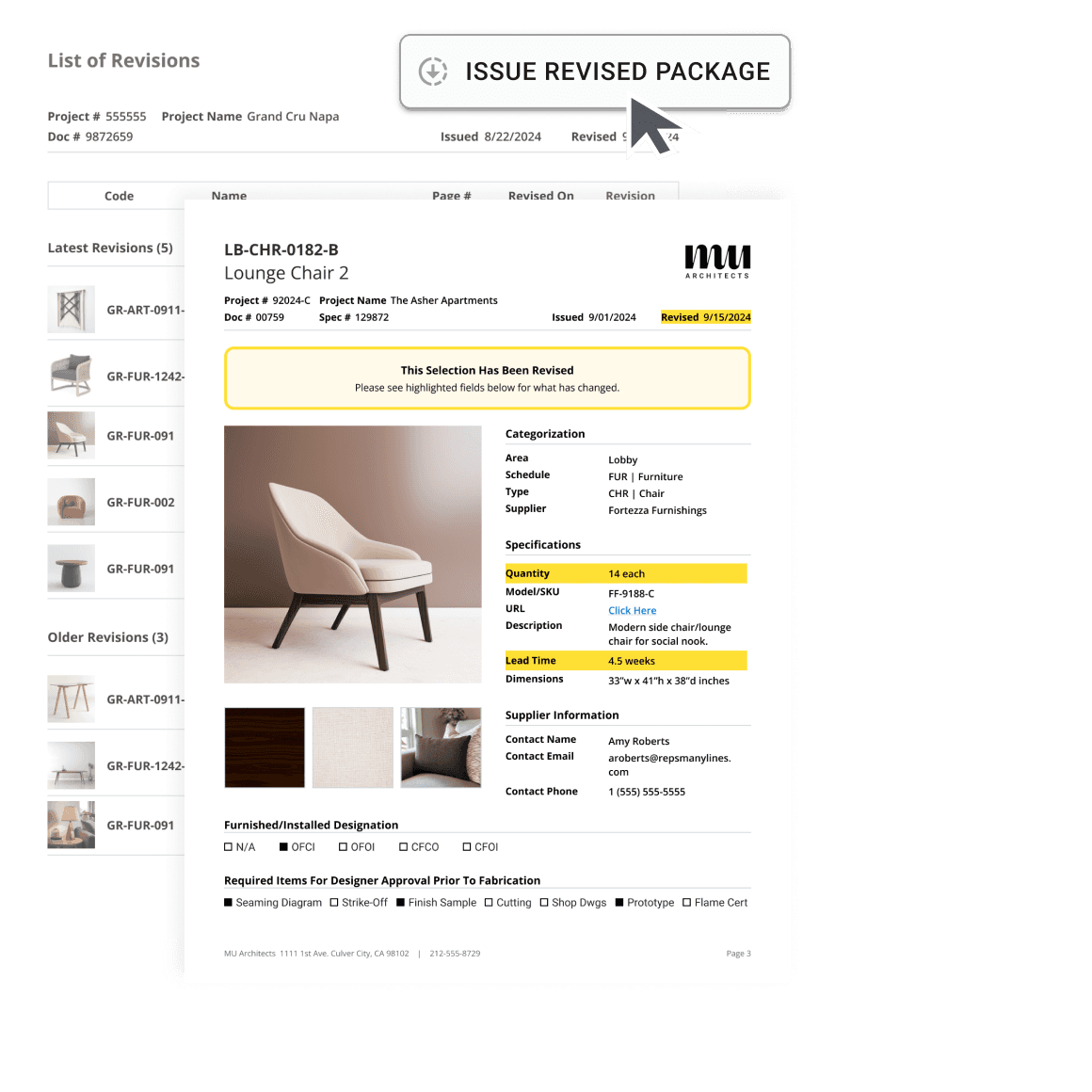

If you are not already a customer, please consider Gather if you need lightweight project & specification management without the complexities that slow you down.